Why and how Coins.ph can improve retention in the next 60 days

Note: This post is heavily influenced by Brian Balfour's Building a Growth Machine. It came from the era when 'growth hacking' was all the rage. I still recommend the thinking and framework to product managers and product marketers alike.

Isn’t bitcoin a scam?

That’s what my aunt asked me when I mentioned wanting to work for Coins.ph, which I consider the most promising tech startup in the Philippines.

Is it a scam? For five minutes, I talked about why it’s not a scam, that the Philippine Peso is not safer than bitcoin, and why she should be taking bitcoin as seriously as she should’ve taken the internet in the 90’s.

And she said, “Eh?”

Consider this —

In my Viber group of 12 friends, my friend JM messaged to say he already booked a hotel for our annual Christmas party. He made the upfront payment of P10,800 and told us to reimburse him via bank transfer.

Ugh. I have a BDO bank account. I use Paypal to bill my foreign clients. I use Splitwise when I’m in the US. I consider myself tech savvy… But ugh. I’ve tried and failed to “enroll” my mom’s account into my online BDO account. Three times! The difficulty — whether perceived or real — of sending money to JM’s bank account is too high for me!

While I felt guilty for imposing a financial burden on him, I didn’t pay him until 1 month (!) later, when we saw each other. In cash.

Contrast that to when I had dinner with my friend who uses Coins—

While waiting for our tan tan mien, he demoed the Coins app to me by firing up his phone and typing my mobile number. I received a text message saying I just received P50. And I didn’t even have a Coins account! Amazing.

All this to say… I want Coins to succeed. It makes financial transactions easier, cheaper, and more accessible. Everybody wins.

And I believe it can succeed, but only if we market it — especially a product like this that’s truly innovative and therefore distrusted by default — the right way.

My theory is that, right now:

- Coins.ph made the right decision to disassociate itself from the distrusted “bitcoin” messaging. (I don’t need to know PHP and Java to get value from Facebook.)

- The challenge: How do they stop using the bitcoin messaging when they are getting hundreds of daily sign ups from “refer a friend for free bits”-driven referrals? I believe these sign up numbers are vanity metrics. They’re acquiring users who sign up out of curiosity, yes, but will never actually use the service and do not move the needle.

- The key is to focus on engagement and retention: Ignore dabblers. Identify users who already understand the core value proposition (easier and cheaper financial transactions) and drive specific behaviors to increase the total value of their transactions, especially with non-users.

By doing this, Coins can parlay the trust of its early adopters to the mainstream, the same way Facebook’s early adopters “poked” me into abandoning my Friendster testimonials for Facebook.

Besides, retention drives all other metrics:

- Acquisition becomes natural and inexpensive. Rabid users find and create new users for you.

- Activation definitely improves. People don’t land on the site cold. They’re there because their friend just sent them money.

- Retention and referral — The more people transact in bitcoin, the more people will transact in bitcoin.

- Revenue — Well…

The more liquid that Bitcoin becomes, the more trade it can absorb, the more it can be used as a medium of exchange, and the easier it will become to profit from a Bitcoin-based service.

“How to Market Bitcoin” by the Nakamoto Institute

Here’s what I’d do in the next 60 days to improve retention in Coins.ph.

Experiment design

Objectives and key results

Objective: Increase retention of active Coins users, which can be measured by total value of transactions made using Coins.

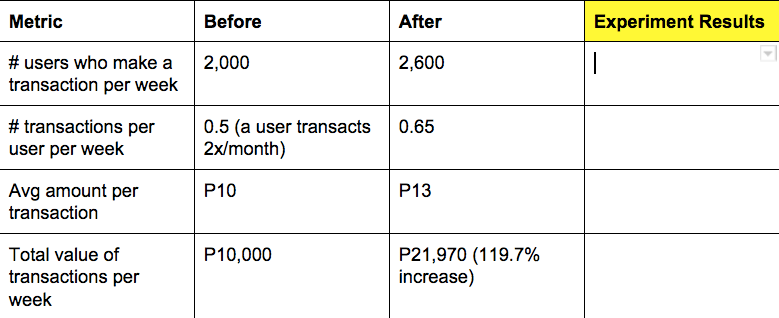

In general, the inputs that affect total transaction value are (1) the number of users who transact in Coins, (2) the number of transactions / user, and (3) average value of each transaction.

Hence, the equation: Total transaction value = (# users who send Coins) * (# transactions / user) * (Avg value / transaction)

Key results:

- Increase # users who send Coins by 30%

- Increase # transactions / user made via Coins by 30%

- Increase average amount / transaction by 30%

30% is arbitrary, but improving 30% across the board will more than double the total value (119.7% increase).

Data gathering and brainstorming (Days 1–30)

Qualitative — Email and talk to customers 1:1:

Preventing churn: You signed up for an account but why did you never use it? You buy load and / or pay bills all the time, why not send money to friends? You sent money to a friend once, why did you stop? You used Coins to remit money once, why did you stop?

Encouraging motivation: When you receive a remittance, what are the first three things you pay for? Thanks for using Coins to send money to friends, what’s the main reason you use it?

Quantitative: Look at data and survey customers.

Among active Coins users… what gadget do they use? Do they have 3G on all the time? What made them sign up? What are the highest value / highest frequency / most regular transactions made over Coins?

Once we get the data, we might find that there are two user archetypes that are most active on Coins:

- Unbanked remittance recipients who have no choice but to transact in cash

- Yuppies who find it a hassle to use traditional banking services

We’ll also come up with a massive list of ideas, which we will save for future experiments.

Backlog:

- Targeted SMS campaign to people who have Mobile data on all day, ex — send automated texts at 7pm Friday to use Coins to split the dinner bill

- Design specific campaigns to drive high value / high frequency / regular transactions

- Track retention effects on acquisition, activation, referral, and revenue.

- Payday loans: Borrow some money from Coins for 1% interest 1 week before remittance arrives (effective interest rate: 52%)

- Cebu Pacific seat sale campaigns (encourage upfront payers to make friends pay up using Coins)

- Customer Evangelism Campaign (send Net Promoter Surveys, develop relationships with self-identified evangelists, create library of public reviews targeting specific use cases and objections, etc.)

But for now, we prioritize. Maybe we decide that it would be most impactful and efficient to target the unbanked remittance recipients since:

- They have money in their Coins wallet and — properly educated and onboarded — can be encouraged to transact using Coins

- They can derive more value from Coins’s core value proposition.

Then we design a simple campaign to see if we can drive specific behaviors from this user archetype and if it will lead to substantial results.

Implementation (Days 31–60)

Experiment with a different user onboarding for December remittances.

Sample workflow:

— When an OFW sends money using Coins, allow and encourage “Coins wallet” as delivery method

— Change user onboarding flow of recipient

- Acquisition: At night, at home, recipient receives text message that she received money

- Activation: One-click sign up to Coins account to access cash.

You don’t have to line up at the ATM machine. Do you know that you can…[buy load] [pay debt] [pay Meralco] [pay Maynilad] … right on your phone?

- First experience of CVP: Try it right now, send P5 to your wife / husband beside you. Just type their number.

Fun, right? Keep money in your wallet so you can load anytime. Paying debt and bills can be that easy. It’s safe and secure in your digital wallet and you can cash out anytime you need money.

- Second experience of CVP: When do you need the money next? [To pay debt] [To pay bills]

- To pay debt… Just type the lender’s number.

- To pay bills… Click here.

- Third experience (next day): Need cash? Cash out at a Security Bank ATM, even if you don’t have an account. Leave some money for your Meralco bill!

- Send monthly text when Meralco is due…

— Track December cohort results after 1 month

And on and on. I could get more specific, but the point is: Instead of acquiring users cold… Identify ideal rabid users, be deliberate in driving specific actions (we already have the features!), and parlay their trust to acquire new users.

Results and learning

The point of an experiment is, of course, to learn. We can hit a 30% improvement on all three key results, or maybe we miss all of them. But if we learn about our users, make a permanent improvement on our product, and get a definite sense of the most impactful activities we can do in the future, we win. That’s what this section is about.

The OKRs again are:

Increase retention of active Coins users, which can be measured by total value of transactions made using Coins.

Key results:

- Increase # users who send Coins by 30%

- Increase # transactions / user made via Coins by 30%

- Increase average amount / transaction by 30%

Hypothesis:

If the experiment is successful, I predict that we will increase total value of transactions per week by 120% because of a 30% increase each in (1) # users who make a transaction per week, (2) # transactions per user per week, and (3) average amount per transaction.

Analysis

- Was the experiment a success or a failure?

- How close were the results to our prediction?

- Why did we get the results we got?

Results

We might find that the experiment increased transaction volume by 100%, 20% lower than expected because… While we were able to reach 30% increase in transaction value and frequency, we were only able to increase # of users transacting by 20%.

What we learned:

- It was more difficult than anticipated to change people’s habit of withdrawing the whole remittance in cash and keep their money in Coins

- But those convinced to send P5 to his wife and buy load happily use Coins to pay debt and bills and engage in higher value transactions

- Etc.

Action items:

- Change messaging to emphasize benefits of keeping money in Coins

- Tweak onboarding flow

- Do more of what worked and eliminate what didn’t

- Experiment with new campaign

- Rinse and repeat

Eventually, my aunt is going to transact in Coins. I know it.

But she’s not gonna get there by clicking on a signup referral link in order to receive 2000 bits.

What’s likely to make it happen is: she’ll receive text messages saying her employee who owes her money sent cash via SMS. She’ll click mindlessly and find herself a holder of a “digital wallet” in Coins.ph.

Suddenly, she’s using Coins to buy MetroDeal coupons, split the dinner bill, and telling my mom to just sign up for Coins. That’s what everybody is doing nowadays.

They wouldn’t even know what hit them.

This post first appeared on Medium.